Now, uncertainty has returned, which means volatility has returned. So today, we'll look at some of the best exchange-traded funds (ETFs) to battle another round of trade jitters.

On-again, off-again talks between the

Certain sectors have taken on hair-trigger demeanors. For instance, technology, which experts think could be heavily targeted in future rounds of tariffs, swings daily on the latest comings and goings out of

The best ETFs to buy if you want to beat back the trade war, then, avoid these sensitive industries and instead focus on businesses that should come out far less scathed than others. Here, we look at seven top funds from various corners of the market.

iShares U.S. Consumer Services ETF

Market value: $896.2 million

Dividend yield: 0.7%

Expenses: 0.43%

Goldman Sachs was quick to the draw following the recent escalation in tariffs. Analyst

"Services Ô¨Ārms are less exposed to trade policy and have better corporate fundamentals than goods companies and should outperform even if the trade tensions are ultimately resolved, as our economists expect," he writes.

The iShares

IYC's entire portfolio of investments sits around 170 stocks that are primarily large-cap ($10 billion or more in market value) and growth-focused in nature. More than half of the fund is invested in general or food-and-staples retailers, with heavy swaths in media and entertainment (23.1%) and consumer services (17.6%). There is also a peppering of companies from the transportation and software industries, among others.

This ETF isn't completely

Learn more about IYC at the iShares provider site.

Utilities Select Sector SPDR Fund

Market value: $9.9 billion

Dividend yield: 3.1%

Expenses: 0.13%

Investors typically look to utility companies for defense against any sort of market turbulence. These companies operate as virtual monopolies, generate extremely reliable revenues and profits, regularly get small rate hikes passed that fuel at least a little growth over time, and frequently deliver much more substantial dividend income than most other sectors.

American utility stocks also just so happen to have another trait that benefits them in this particular predicament: lack of exposure to

The

The ETF is an unsurprisingly high yielder, too, at 3.1% - behind only SPDR's real estate fund (3.3%) and tied with its energy ETF.

Learn more about XLU at the SPDR provider site.

SPDR S&P Regional Banking ETF

Market value: $2.1 billion

Dividend yield: 2.0%

Expenses: 0.35%

Bank stocks are in a delicate situation right now. On the one hand, tariffs very well could crimp

The flip side? Some experts are opining that a slowdown could trigger a

Regional banks are a strong target right now. Not only do they operate almost entirely domestically, but they also don't have added complications from operations such as trading desks that could suffer if investors become standoffish. And for years, they have benefited from rampant mergers and acquisitions, such as this year's tie-up between large regionals SunTrust (STI) and

Learn more about KRE at the SPDR provider site.

iShares Cohen & Steers REIT ETF

Market value: $2.2 billion

Dividend yield: 2.7%

Expenses: 0.34%

Real estate investment trusts (REITs), for the uninitiated, are a special class of company that was created by

The iShares Cohen & Steers REIT ETF (ICF, $112.47) tracks an index built by

ICF features a tight portfolio of 30 large REITs that "are dominant in their respective property sectors." These include the likes of telecom infrastructure company

You could gripe about ICF's relatively meager yield of 2.7% that compares poorly to most of the higher-asset REIT ETFs. But the fund's price performance is so consistently strong that even its total returns (price plus dividends) topple that of most rivals.

Learn more about ICF at the iShares provider site.

Invesco S&P SmallCap Low Volatility ETF

Market value: $2.0 billion

Dividend yield: 2.3%

Expenses: 0.25%

Small-cap stocks frequently are touted as a getaway from international troubles. These companies typically derive most if not all of their revenues from within the

Still, the trade war with

The Invesco S&P SmallCap Low Volatility ETF (XSLV, $47.73) is the best of a lot of worlds. XSLV holds the 120 stocks in the S&P SmallCap 600 that have the lowest realized volatility over the past 12 months - so you get the aforementioned benefits of smaller companies, but back out many of the riskier names.

As a result, its sector breakdown is well-tailored for success. Financial stocks (mostly regional banks and credit unions) make up a whopping 47.3% of the portfolio, followed by (mostly domestic) REITs at 21.7%. Another 5.6% is dedicated to utilities. Without even delving into some of the smaller allocations, three-quarters of this ETF's assets are piled into somewhat "protected" sectors.

XSLV's top holdings include several REITs that invest in mortgages and other real estate "paper," including

Learn more about XSLV at the Invesco provider site.

Invesco S&P Emerging Markets Low Volatility ETF

Market value: $329.0 million

Dividend yield: 5.3%

Expenses: 0.29%

The

But

"We do like EMs, we do think the demographics are good, but there is disruption" from the trade conflict from the

"A low-volatility screen is maybe one of our favorite ways to play volatile markets, not just in EMs, but in the

The Invesco S&P Emerging Markets Low Volatility ETF (EELV, $23.20) is one of the best ETFs for this specific strategy. The fund invests in 200 stocks from an index of large- and mid-cap emerging markets companies that have exhibited the least volatility over the past 12 months. Right now, its portfolio contains just 10 countries, and whereas many EM funds are heavily weighted in

Learn more about EELV at the Invesco provider site.

Pimco Active Bond Exchange-Traded Fund

Market value: $2.3 billion

Dividend yield: 3.2%

Expenses: 0.76%

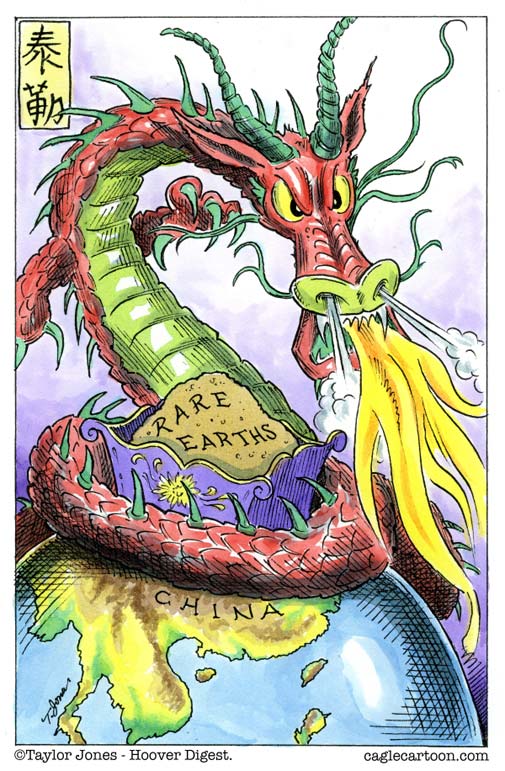

One of the theories floated around is the "nuclear option" - that

"

Outside that worst-case scenario, investors may continue to view Treasuries and other bonds as a source of safety against volatility, thus driving prices higher.

The uncertain landscape seems to favor the agility of skilled active management over a plain-Jane index.

BOND, helmed by

This five-star Morningstar-rated ETF has rewarded above-average risk with high returns. It has beaten the Bloomberg Barclays US Aggregate Bond (Agg) benchmark in every significant time period since inception in 2012.

Kyle Woodley is Senior Investing Editor at Kiplinger.

Contact The Editor

Contact The Editor

Articles By This Author

Articles By This Author