Compound Semiconductor Market Size & Growth Analysis

The Compound Semiconductor Market is expanding with demand for high-performance electronics in 5G, automotive, and aerospace.

AUSTIN, TX, UNITED STATES, February 17, 2025 /

EINPresswire.com/ -- Market Size & Industry Insights

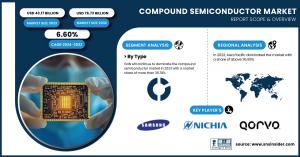

According to the SNS Insider Report,“The

Compound Semiconductor market was valued at USD 43.17 billion in 2023 and is expected to grow to USD 76.73 billion by 2032, at a CAGR of 6.60% over the forecast period of 2024-2032.”

Demand for high-performance electronics, 5G, electric vehicles (EV), and advanced defense electronics are creating the growth of the compound semiconductor market. These have excellent characteristics such as high electron mobility, efficiency, and thermal stability distinguish them as ideal for a variety of applications including power electronics, RF devices, and optoelectronics.

Get Free Sample PDF of Compound Semiconductor Market (with Full TOC & Graphs) @

https://www.snsinsider.com/sample-request/2442

SWOT Analysis of Key Players as follows:

- Nichia Corporation

- Samsung Electronics

- NXP Semiconductor

- Infineon Technologies

- Taiwan Semiconductor

- QORVO

- CREE

- Renesas Electronics Corporation

- Stmicroelectronics

- Texas Instruments Incorporated

- OSRAM AG

- Skyworks

- Wolfspeed Inc.

- GaN Systems

- Canon Inc.

- Infineon Technologies AG

- Mitsubishi Electric

Key Market Segmentation:

By Decomposition Technology: Chemical Vapor Deposition (CVD) held the largest market share in the global compound semiconductor market in 2023 owing to its capability of producing uniform & high-quality thin films which are imperative for various semiconductor applications. CVD is a popular technique used for the fabrication of power electronics, optoelectronics, and RF devices and is preferred by manufacturers.

The Atomic Layer Deposition (ALD) type is estimated to observe the highest CAGR growth from 2024 to 2032 in the semiconductor deposition equipment market. The ability to precisely deposit ultra-thin, conformal layers makes ALD a perfect candidate for next-generation semiconductor technology such as scaled-down transistors, elaborate sensors, and quantum computing parts.

By Type: In 2023 Gallium Nitride (GaN) held the largest share of the total compound semiconductor market owing to its higher efficiency, high power density, and very good thermal performance. GaN has become the optimal material in high-frequency and high-power scenarios. Therefore, GaN is widely used in 5G base stations, radar systems, satellite communications, power electronics, etc.

Silicon Carbide (SiC) is expected to grow at the fastest CAGR from 2024 to 2032. The unique thermal conductivity, high breakdown voltage, and energy efficiency of SiC are the reasons for its suitability for next-generation power electronics, particularly for the conversion of power in electric vehicles (EVs) as well as renewable energy systems and industrial applications. The rapid growth of silicon carbide (SiC) power semiconductors is owing to a significant transition towards energy-efficient solutions and the adoption of charging infrastructure for electric vehicles (EVs) and solar inverters.

Connect with Our Expert for any Queries @

https://www.snsinsider.com/request-analyst/2442

By Product: Power Electronics held the largest share of the compound semiconductor market in 2023, owing to the rising significance of efficient power management solutions across industries. With the rapid growth of power electronics making an important contribution in the areas of electric vehicles, renewable energy systems, and high-performance industrial applications, this Trail is now active.

The Optoelectronics segment will garner the largest compound annual growth rate (CAGR) from 2024 to 2032. This expansion is fueled by increasing requirements for cutting-edge display technologies, high-speed communication systems, and low-energy lighting solutions. The growing use of light-emitting diodes (LEDs), laser diodes, and photovoltaic cells in consumer electronics, automotive lighting, and solar power generation demonstrates the wide range of applications performed by optoelectronic devices.

By Application: In 2023, the Telecommunication industry hold the largest share of the overall compound semiconductor market. This leadership comes from fast 5G network implementations as well as a growing need for high-speed communication systems, which require high-performance components that can only be achieved with the use of compound semiconductors such as gallium nitride (GaN) and gallium arsenide (GaAs).

The Automotive industry is projected to have the highest compound annual growth rate (CAGR) of all sectors from 2024 to 2032. The expected increase comes from the growing trend of electric vehicles and advanced driver-assistance systems (ADAS) that need more efficient power electronics and high-frequency components. As a result, the growing use of high-efficiency and high-thermal-conductivity materials like silicon carbide (SiC) and GaN in automotive powertrains and charging infrastructure is accelerating the expansion of compound semiconductors, which have come to play a significant role in the automotive sector.

Asia Pacific Leads the Compound Semiconductor Market While North America Rises Fastest

Asia Pacific region held the largest share of the compound semiconductor market in 2023 due to high demand at least from countries such as China, Japan, South Korea, and Taiwan. Strong government support and the presence of leading semiconductor industry players contribute to the region leading the pack with an established semiconductor manufacturing ecosystem. Consumer electronics, telecommunications, and automotive industries are all backgrounds for the diffusion of compound semiconductors, and Asia Pacific is a hotspot for these industries.

North America will increase at the highest rate during the forecast period from 2024 to 2032, due to the growing semiconductor fabrication investments and the rise in demand for advanced technologies for telecommunication, aerospace, defense, and electric vehicles. Driving this growth is the U.S. government's efforts to increase domestic semiconductor manufacturing capacity and increase the usage of compound semiconductors in AI, 5G, and renewable energy applications.

Purchase Single User PDF of Compound Semiconductor Market Forecast Report @

https://www.snsinsider.com/checkout/2442

TABLE OF CONTENT - Key Points

Chapter 1. Introduction

Chapter 2. Executive Summary

Chapter 3. Research Methodology

Chapter 4. Market Dynamics Impact Analysis

Chapter 5. Statistical Insights and Trends Reporting

Chapter 6. Competitive Landscape

Chapter 7. Compound Semiconductor Market Segmentation, by Deposition Technology

Chapter 8. Compound Semiconductor Market Segmentation, by Type

Chapter 9. Compound Semiconductor Market Segmentation, by Product

Chapter 10. Compound Semiconductor Market Segmentation, by Application

Chapter 11. Regional Analysis

Chapter 12. Company Profiles

Chapter 13. Use Cases and Best Practices

Chapter 14. Conclusion

Continued…

Make an Inquiry Before Buying @

https://www.snsinsider.com/enquiry/2442 Akash Anand

SNS Insider

+1 415-230-0044

info@snsinsider.com