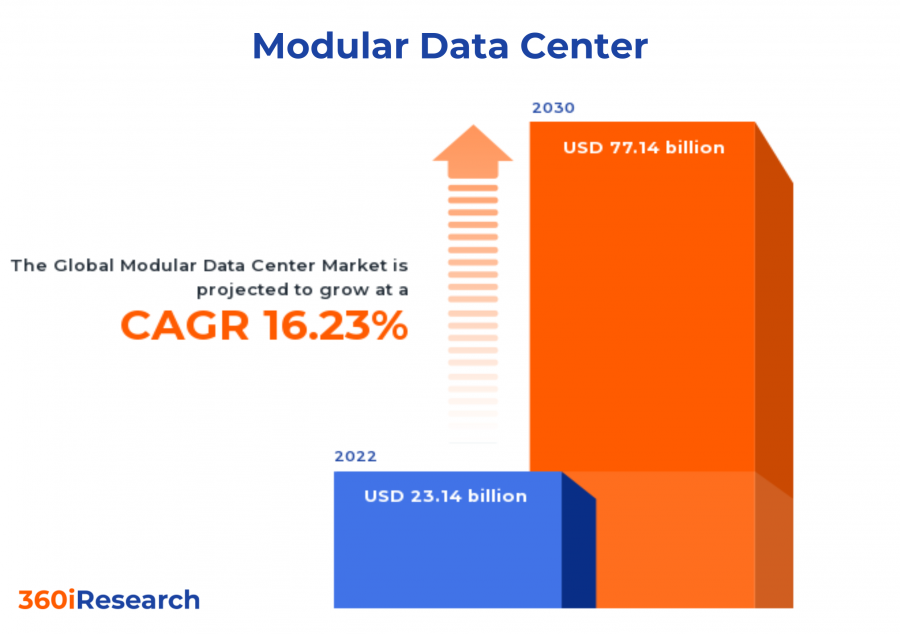

Modular Data Center Market worth $77.14 billion by 2030, growing at a CAGR of 16.23% - Exclusive Report by 360iResearch

The Global Modular Data Center Market to grow from USD 23.14 billion in 2022 to USD 77.14 billion by 2030, at a CAGR of 16.23%.

PUNE, MAHARASHTRA, INDIA , December 7, 2023 /EINPresswire.com/ -- The "Modular Data Center Market by Component (Functional Module Solutions, Services), Data Center Size (Large Data Centers, Mid-Sized Data Centers), Tier Type, Application, Vertical - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.

The Global Modular Data Center Market to grow from USD 23.14 billion in 2022 to USD 77.14 billion by 2030, at a CAGR of 16.23%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/modular-data-center?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

A Modular Data Center (MDC) refers to a portable method of deploying data center capacity. MDP individual modules are designed and built separately and then assembled to form the complete data center. MDCs play a pivotal role in various sectors, including technology and telecom businesses, energy and manufacturing, and government & military operations to manage the explosion of data and the need for near-instant access to computing resources. The rapid pace of digital transformation across industries, along with the rising cloud services adoption, is driving the growth of the market. The demand for portable and flexible IT solutions among businesses as they expand globally has also propelled the growth of modular data center solutions. Additionally, the rise of edge computing, where data processing is located closer to the end-user's location, is contributing to the expansion of the modular data center market. The perception and handling of the initial deployment cost hinder the market growth. Furthermore, data sovereignty issues and the need for secure data handling protocols can limit the deployment of these units across the globe. Technological advancements are fostering the development of highly efficient and sustainable modular data center facilities. Innovations in cooling technologies, the use of advanced power distribution systems, and the integration of renewable energy sources are trends reinforcing the attractiveness of these solutions.

Tier Type: Rising preference for Tier 4 data centers for mission-critical operations with near-zero downtime

For Tier 1 data centers, characterized by basic infrastructure, modular designs enhance efficiency and adaptability, providing a cost-effective approach even for non-critical applications. Tier 1 data centers are suited for non-critical applications. In Tier 2 environments, where improved redundancy is essential, modular elements offer flexibility for scaling and maintenance without disrupting operations. Tier 3 data centers, known for high availability, benefit from modular construction, efficiently accommodating critical applications while ensuring minimal downtime. For Tier 4 data centers designed for mission-critical operations with near-zero downtime, modular features enhance adaptability and resilience, contributing to the robustness of these advanced facilities. This integration of modular principles aligns data center infrastructure with specific reliability needs while offering the benefits of scalability and rapid deployment.

Application: Rising usage of modular data centers for expanding data center capacity to meet growing computational demands

Modular designs provide a scalable solution for expanding data center capacity to meet growing computational demands. Quick deployment allows businesses to adapt swiftly to increased workloads without the need for extensive construction. Modular solutions facilitate the seamless expansion of existing data centers, enabling organizations to incrementally grow their IT infrastructure in response to evolving requirements. The modular nature of these data centers enhances disaster recovery capabilities by offering a rapidly deployable and redundant infrastructure, ensuring business continuity in the face of unexpected disruptions. Modular data centers prove invaluable for emergency and temporary deployments, providing a rapid and flexible solution in scenarios such as disaster response, temporary event needs, or mobile computing requirements. Tailored for high-performance computing and edge computing applications, modular data centers efficiently deliver computational power closer to end-users or in remote locations, supporting critical applications with low latency.

End-User: Emerging potential of modular data centers in the BFSI sector to secure sensitive financial data

Banking & financial institutions benefit from modular data centers for secure and scalable storage of sensitive financial data, ensuring compliance with regulatory requirements. Educational institutions deploy modular data centers to support growing IT requirements, providing a scalable and cost-effective solution for managing academic and administrative data. The energy sector leverages modular data centers for efficient data management and analysis in areas such as smart grids, energy monitoring, and resource optimization. Government & defense agencies benefit from modular data centers for secure and rapid deployment of critical IT infrastructure, supporting various applications, including command and control systems. Healthcare organizations use modular data centers for managing electronic health records, facilitating medical research, and ensuring the availability of critical healthcare applications. In the IT & telecommunications sector, modular data centers provide a flexible and scalable solution for managing networks, supporting data storage, and enabling quick deployment in various locations. Manufacturing industries deploy modular data centers to optimize production processes, manage supply chain data, and enhance operational efficiency through real-time analytics. Retailers & consumer goods industries utilize modular data centers for managing e-commerce platforms, inventory systems, and customer data, ensuring efficient and scalable operations.

Data Center Size: Growing adoption of large modular data centers to create a flexible and adaptable infrastructure

Large modular data centers combine the benefits of scalability and rapid deployment associated with modular designs while accommodating the extensive computing needs of large enterprises or organizations. These facilities leverage modular components to create a flexible and adaptable infrastructure that can efficiently scale with growing data processing demands. The large-scale nature of these modular data centers allows for the consolidation of significant computing power, making them well-suited for handling extensive workloads, supporting cloud services, and facilitating centralized data processing. The integration of modular principles into large data center designs enhances efficiency, agility, and responsiveness to the evolving requirements of modern IT environments. Mid-sized modular data centers provide a balance between scalability and a more moderate computing infrastructure. These facilities leverage modular design principles to offer a flexible solution for organizations with moderate data processing and storage needs. The modular approach allows for quicker deployment and adaptability to changing IT requirements, making them suitable for businesses that may not require the scale of a large data center.

Component: Expanding role of software in modular data centers for optimal utilization of resources

Hardware constitutes one of the key components in the modular data center market. It involves advanced integrated systems, storage devices, servers, and network equipment. The demand for modular data center hardware has been significantly rising, mainly attributable to the increasing necessity for quick and scalable data center infrastructure. The software includes data center infrastructure management (DCIM) software that helps in the optimal utilization of resources. DCIM software is gaining popularity as it facilitates energy efficiency by tracking, managing, and controlling energy consumption. Enhanced digitalization across businesses, natural user interfaces in tandem with data center lifecycle improvements, and cost benefits provided by DCIM software stimulate the software market within the modular data center sector. The service segment is discerned by two sub-segments, namely, consulting services and integration and deployment services. Consulting service providers help organizations to recognize the type of modular data center suitable to their needs. On the other hand, integration and deployment service providers assist the organizations in implementing and integrating the modular data centers into their business systems. The expansion of the service sector can be attributed to increasingly complex data center workloads and the widespread utilization of modular data centers.

Regional Insights:

The American region hosts the advanced IT infrastructure and is home to large technology corporations that are key consumers of modular data centers. The rapid expansion of cloud services, a strong focus on data center consolidation, and advanced technological adaptability are driving the deployment of modular data centers across the American region. Europe holds a significant market stake in the modular data center sector. The European market is stimulated by stringent government regulations pertaining to data sovereignty and energy efficiency. The EU countries, including the United Kingdom, Germany, and the Nordic countries, are prominent markets due to their robust IT infrastructure and focus on sustainable data center solutions. The Middle East and Africa show potential for growth due to increasing investments in IT infrastructure, especially in countries such as the UAE and Saudi Arabia. Significant investments in smart city initiatives and sustainable technology are further contributing to the market growth in the region. The Asia-Pacific region is witnessing rapid development in the modular data center attributed to the burgeoning IT and telecommunications sectors in countries such as China, India, and Japan. The emerging trend of smart city projects across the APAC region that are integrating MDCs for efficient data management. The push for digital transformation and the need to manage exponentially growing data propel the APAC region's market forward.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Modular Data Center Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Modular Data Center Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Modular Data Center Market, highlighting leading vendors and their innovative profiles. These include Amazon Web Services, Inc., American Tower Corporation, Attom Technology, Baselayer Technology, LLC by Intermountain Electronics, Inc., BASX Solutions, Compass Datacenters, LLC, CPG Beyond, Inc., DartPoints, DComm Ventures Pty Ltd., Dell, Inc., Delta Electronics, Inc., Eaton Corporation, Fujitsu Ltd., Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., NEC Corporation, Oracle Corporation, PCX Holding LLC by Hubbell Incorporated, Prasa Infocom & Power Solutions Pvt. Ltd., Rittal Limited, Schneider Electric SE, Shenzhen Kstar Science & Technology Co., Ltd., Sonic Edge, Vertiv Group Corp., and ZTE Corporation.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/modular-data-center?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Modular Data Center Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Component, market is studied across Functional Module Solutions and Services. The Functional Module Solutions is further studied across All-in-one Functional Module and Individual Functional Module. The Individual Functional Module is further studied across Cooling Module, Electrical Module, IT Module, Mechanical Module, and Power Module. The Services is further studied across Consulting, Infrastructure Management, and Integration & Deployment. The Services is projected to witness significant market share during forecast period.

Based on Data Center Size, market is studied across Large Data Centers and Mid-Sized Data Centers. The Mid-Sized Data Centers is projected to witness significant market share during forecast period.

Based on Tier Type, market is studied across Tier 1 Data Centers, Tier 2 Data Centers, Tier 3 Data Centers, and Tier 4 Data Centers. The Tier 2 Data Centers is projected to witness significant market share during forecast period.

Based on Application, market is studied across Capacity Expansion, Data Center Expansion, Disaster Recovery, Emergency & Temporary Deployment, and High Performance or Edge Computing. The Emergency & Temporary Deployment is projected to witness significant market share during forecast period.

Based on Vertical, market is studied across Banking, Financial Services, & Insurance, Education, Energy, Government & Defense, Healthcare, IT & Telecommunications, Manufacturing, and Retail & Consumer Goods. The Manufacturing is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 39.14% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Modular Data Center Market, by Component

7. Modular Data Center Market, by Data Center Size

8. Modular Data Center Market, by Tier Type

9. Modular Data Center Market, by Application

10. Modular Data Center Market, by Vertical

11. Americas Modular Data Center Market

12. Asia-Pacific Modular Data Center Market

13. Europe, Middle East & Africa Modular Data Center Market

14. Competitive Landscape

15. Competitive Portfolio

16. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Modular Data Center Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Modular Data Center Market?

3. What is the competitive strategic window for opportunities in the Modular Data Center Market?

4. What are the technology trends and regulatory frameworks in the Modular Data Center Market?

5. What is the market share of the leading vendors in the Modular Data Center Market?

6. What modes and strategic moves are considered suitable for entering the Modular Data Center Market?

Mr. Ketan Rohom

360iResearch

+ +1 530-264-8485

ketan@360iresearch.com

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release