Navigating DEI Disclosure amid Regulatory Shifts

Executive Summary: Strategic Navigation of DEI Disclosure Shifts (2022–2025)

Overview

Diversity, Equity, and Inclusion (DEI) disclosures in SEC filings evolved dynamically from 2022 to early 2025, driven by a variety of factors, including legal scrutiny, shareholder demands and numerous regulatory shifts. DEI disclosures have reached a pivotal moment. Once expanding as part of corporate governance and ESG strategies, DEI statements are increasingly scrutinized and, in some cases, strategically reduced. This summary provides an overview of key trends shaping DEI narratives in SEC filings among a selected group of ten S&P 100 companies, equipping legal, compliance, and investor relations teams with data-driven insights to navigate this evolving landscape.

This report combines DragonGC’s disclosure analytics to examine the selected disclosures, identify trends, and provide practical examples to guide DEI disclosure strategies in 2025. The report also examines the regulatory and legal context of the shifting DEI landscape and summarizes the key drivers influencing corporate DEI disclosures.

Why This Matters

With new Executive Orders in place and shareholder expectations evolving around DEI, the approaches leading companies are adopting with their DEI disclosures can help companies understand the current landscape and provide examples that can help guide their disclosure strategy.

This report analyzes DEI disclosure trends across SEC filings from 2022 to early 2025, focusing on a sample of 10 S&P 100 exemplar companies: Apple, Microsoft, JPMorgan Chase, Berkshire Hathaway, Walmart, Target, Citigroup, Intel, Southern Company, and ExxonMobil. These firms were selected to provide a robust foundation for understanding broader S&P 100 trends, based on their sectoral diversity, range of disclosure strategies, and alignment with key legal and regulatory drivers. Our methodology leverages qualitative case studies and quantitative frequency analysis (e.g., Natural Language Processing of DEI terms), drawing from 10-K and DEF 14A filings to track shifts over the study period. See Appendix B for notes on methodology.

Industry-Wide Trends in DEI Disclosures (2022-2025)

DragonGC’s selected companies for this analysis span technology (Apple, Microsoft, Intel), financials (JPMorgan Chase, Citigroup), retail (Walmart, Target), utilities (Southern Company), energy (ExxonMobil Corp.) and conglomerates (Berkshire Hathaway), reflecting a spectrum of DEI approaches. Using Natural Language Processing (NLP) techniques, we tracked terms like “Diversity,” “Equity,” “DEI,” and “Belonging” across 2022-2024 filings, with early 2025 data from leaders like Apple and JPMorgan Chase offering a glimpse into emerging shifts.

Our selection criteria included:

- Technology (25%) – Companies like Apple and Microsoft have been historically vocal about DEI, while Intel provides insight into how semiconductor firms approach disclosure.

- Financials (20%) – Financial institutions such as JPMorgan Chase and Citigroup offer a window into how regulatory and shareholder expectations influence DEI reporting.

- Retail (15%) – Walmart and Target are consumer-driven companies that respond to DEI concerns from both customers and investors.

- Utilities & Industrials (10%) – Companies like Southern Company illustrate disclosure trends in essential services and infrastructure sectors.

- Energy (10%) – ExxonMobil represents the energy sector, offering insight into how high-profit, traditional industries with historically minimal DEI emphasis adjust disclosures amid shifting expectations.

- Conglomerates & Other (20%) – Berkshire Hathaway allows us to examine how diversified businesses approach (or avoid) DEI disclosures.

Regulatory & Legal Context: The Shifting DEI Landscape (2022–2025)

Evolving legal and regulatory forces have significantly influenced corporate DEI disclosures. The interplay between executive actions, judicial rulings, and regulatory guidance has recalibrated corporate diversity, equity, and inclusion (DEI) commitments. This section chronologically examines the primary drivers shaping DEI disclosure trends from 2022 to early 2025.

- 2023 Supreme Court Ruling: Restricts Race-Conscious Policies, Influencing Corporate DEI Disclosures In June 2023, the Supreme Court’s ruling in Students for Fair Admissions v. Harvard declared race-based affirmative action in college admissions unconstitutional. This ruling significantly impacted corporate DEI strategies, prompting firms like JPMorgan Chase to shift to neutral “Workforce Composition” language to align with the decision.

- Nasdaq Diversity Rule Challenges (2023–2025): Ongoing Uncertainty Affects Reporting The SEC-approved Nasdaq board diversity rule, effective from 2023, required listed companies to disclose board diversity statistics or explain noncompliance. It was vacated by the Fifth Circuit on Dec. 11, 2024, and Nasdaq formally withdrew the rule on January 24, 2025.

- SEC Human Capital Disclosure Focus (2020–Present): Transparency Remains Despite Terminology Shifts Since 2020, the SEC’s principles-based human capital disclosure requirements have continued driving transparency, including workforce demographics and inclusion efforts. Despite shifts in DEI terminology and reduced explicit DEI references (such as Microsoft’s reduction in DEI-specific disclosures in its 2024 10-K), corporate transparency obligations remain robust.

- Executive Order 14173 (January 2025): Ends Federal Affirmative Action Mandates On January 21, 2025, Executive Order 14173 revoked federal DEI mandates, directing agencies to prioritize merit-based hiring and eliminate race-based affirmative action in federal contracting. Effective April 20, 2025, this shift caused companies like Microsoft and Target to further revise their DEI disclosures, expanding on preemptive reductions begun in 2024.

- Federal Court Temporarily Blocks DEI Executive Orders (February 2025) Creates Uncertainty: On February 21, 2025, a federal court in Maryland temporarily blocked key provisions of recent Executive Orders (EO 14151 and EO 14173) relating to DEI. This temporary restraining order (TRO) halted enforcement actions against private-sector DEI initiatives but did not block investigative directives aimed at identifying “illegal DEI” practices in private companies. Companies now face continued uncertainty regarding compliance with DEI policies and practices amidst ongoing litigation.

- Additional Legal Challenges and Guidance (February 2025): Further complicating the landscape, additional lawsuits, such as National Urban League v. Trump (filed February 19, 2025), challenge the administration’s anti-DEI stance on constitutional grounds. Additionally, on February 19, 2025, attorneys general from sixteen states issued guidance encouraging employers to maintain lawful DEI practices, emphasizing broader protections under state law.

These developments underscore the heightened uncertainty for corporate leaders regarding DEI commitments. Companies must carefully navigate between federal directives, judicial challenges, regulatory expectations, and evolving state-level legal landscapes. Conducting internal audits of DEI policies and maintaining awareness of legal changes remain essential steps in mitigating compliance risks amid this evolving landscape. 4

Case Study Highlights

-

Apple: Maintaining DEI Commitments

- According to Apple’s 2025 Annual Meeting of Shareholders held on February 25, 2025, shareholders voted on a proposal titled “Request to Cease DEI Efforts” (Item 6). This proposal was rejected with 8,843,175,086 votes against it (approximately 97.7% of votes cast, excluding abstentions and broker non-votes), while only 210,451,697 votes (approximately 2.3%) were in favor. This overwhelming rejection of the anti-DEI proposal does indeed demonstrate strong shareholder support for Apple’s continued diversity, equity, and inclusion initiatives. The voting results show that the vast majority of participating shareholders want Apple to maintain its DEI efforts rather than cease them.

-

Microsoft: Strategic Retraction

- Microsoft reduced DEI references by 76% in its 2024 10-K, shrinking the section from approximately 250 to 60 words and eliminating identity group mentions entirely. This preemptive shift, occurring before Executive Order 14173, reflects a move to generalized inclusion language amid legal scrutiny.

-

JPMorgan Chase: Language Shift

- The bank maintained demographic reporting but rebranded “Diversity, Equity, and Inclusion” as “Workforce Composition” in its 2025 10-K, reducing explicit DEI mentions while preserving substantive diversity metrics, such as achieving 50% women on its board by 2025.

-

Target: Legal Considerations Drive Reduction

- Target’s 2024 10-K condensed DEI discussion by 30%, cutting word count from roughly 130 to 90 and removing experiential language like “seen, heard, and welcome,” while retaining general inclusion statements and reporting commitments amid legal pressures.

-

Berkshire Hathaway: DEI Absent by Design

- Berkshire Hathaway continues to exclude DEI terminology entirely from its disclosures across 2022-2025 10-Ks and DEF 14As, with its 2023 DEF 14A explicitly stating the Governance Committee “does not seek diversity,” aligning with its minimalist disclosure philosophy.

-

Walmart: Alternative Framing Adoption

- Walmart introduced “belonging” in its 2024 10-K, shifting from “diversity, equity, and inclusion” to “belonging, diversity, equity, and inclusion,” framing DEI as a business driver that “strengthens our business” while maintaining workforce statistics, such as 51% people of color in the U.S. in 2024.

-

Citigroup: Subtle Continuity Amid Caution

- Citigroup dropped the explicit “DEI” label in its 2024 10-K but retained diversity-related content under broader workforce discussions, focusing on board diversity with eight diverse nominees noted in its 2024 DEF 14A, balancing legal caution with investor expectations.

-

Intel: Steady but Minimalist Approach

- Intel maintained consistent, brief DEI mentions in its 2021 – 2024 10-K risk factors, such as “build and maintain a diverse and inclusive workplace,” avoiding expansion or specificity despite market trends, reflecting a cautious, business-focused stance. • Southern Company: Silent on DEI in Business Section Southern Company omitted DEI disclosures entirely from its “Item 1. Business” section in 2021–2022 10-Ks, potentially relegating such content elsewhere or signaling a strategic choice to avoid DEI emphasis in core filings.

-

ExxonMobil Corp.: Limited Visibility

- ExxonMobil’s DEI approach lacks specific highlights beyond its inclusion in the report’s sample of exemplar firms. No explicit DEI mentions or trends are detailed in the provided 10-K or DEF 14A excerpts, suggesting minimal disclosure or placement outside analyzed sections.

Apple’s DEI Shareholder Vote as a Counterpoint

Despite broader regulatory shifts, data from Apple’s proxy statements (DEF 14A) suggests a decline in anti-DEI shareholder proposal support from 2023 to 2025, indicating sustained investor interest in diversity policies amid evolving legal and regulatory challenges.

SEC Human Capital Disclosure Focus

Public companies have expanded workforce-related disclosures since the SEC introduced principles-based human capital disclosure requirements in 2020. While the DEI component of these disclosures has faced scrutiny, the SEC continues to emphasize transparency in:

- Workforce demographics (gender, ethnicity, representation levels)

- Employee retention and inclusion efforts

- Risk factors tied to human capital management

Market Response

- Microsoft (2024 10-K): Scaled back its DEI-specific disclosures but retained human capital risk factors.

- Target (2024 10-K): Maintained broad workforce diversity commitments despite ongoing litigation.

- Berkshire Hathaway: Continued zero DEI disclosures, reinforcing its historical stance.

This trajectory suggests a peak in corporate DEI commitments in 2024, followed by a recalibration in 2025 amid evolving regulatory and political scrutiny.

Sector-Specific Insights

Technology: A Mixed Commitment

- Apple: In each of the 10-K filings from 2022, 2023, and 2024, Apple consistently mentions “diversity, equity and inclusion” exactly once in each filing, where it is mentioned twice. These mentions appear in nearly identical contexts across the years, specifically in sections discussing environmental, social, and governance (ESG) considerations.

- Microsoft: Reduced DEI section size by 76% between 2023-2024, cutting identity group references.

- Intel: Static DEI language, focusing on risk-related disclosures.

Financials: A Shift Toward Neutral Framing

- JPMorgan Chase: Transitioned from explicit “Diversity, Equity & Inclusion” to “Workforce Composition” in 2025.

- Citigroup: Reduced DEI mentions by 30% from 2023 to 2024.

Retail: Experimenting with Alternative Language

- Walmart: Introduced “Belonging” as an alternative DEI term in 2024.

- Target: Reduced DEI section size by 30% amid legal pressures.

Conglomerates & Industrial Giants: Minimal or No DEI Emphasis

- Berkshire Hathaway: Minimal or No DEI Emphasis.

Energy

- ExxonMobil – From Detailed Metrics to Minimal Engagement: ExxonMobil’s approach to DEI disclosures shifted markedly from 2023 to 2025, as evidenced in its 10-K filings. In 2023, the company provided specific metrics – such as “37 percent of U.S. hires for management, professional, and technical positions were minorities” – highlighting a focus on workforce diversity. By 2024-2025, however, these filings eliminated quantitative details and procedural commitments, retaining only a single reference to “diversity of thought, ideas, and perspective” in the 2025 10-K Item 1. No explicit mentions of “Diversity,” “Equity,” or “Inclusion” appear in the 2022-2025 risk factor excerpts, with DEI-related themes addressed indirectly through regulatory and stakeholder risks. This retreat from specificity aligns with trends in traditional, high-profit industries where DEI has often been deprioritized. ExxonMobil’s minimal engagement by 2025 reflects a strategic choice to reduce legal and shareholder exposure amid the regulatory shifts of 2022-2025, including the Supreme Court’s affirmative action ruling and state-level DEI challenges. ExxonMobil reported 37% minority hires in 2023, shifting to ‘diversity of thought’ in 2024 and ‘global workforce composition’ in 2025.

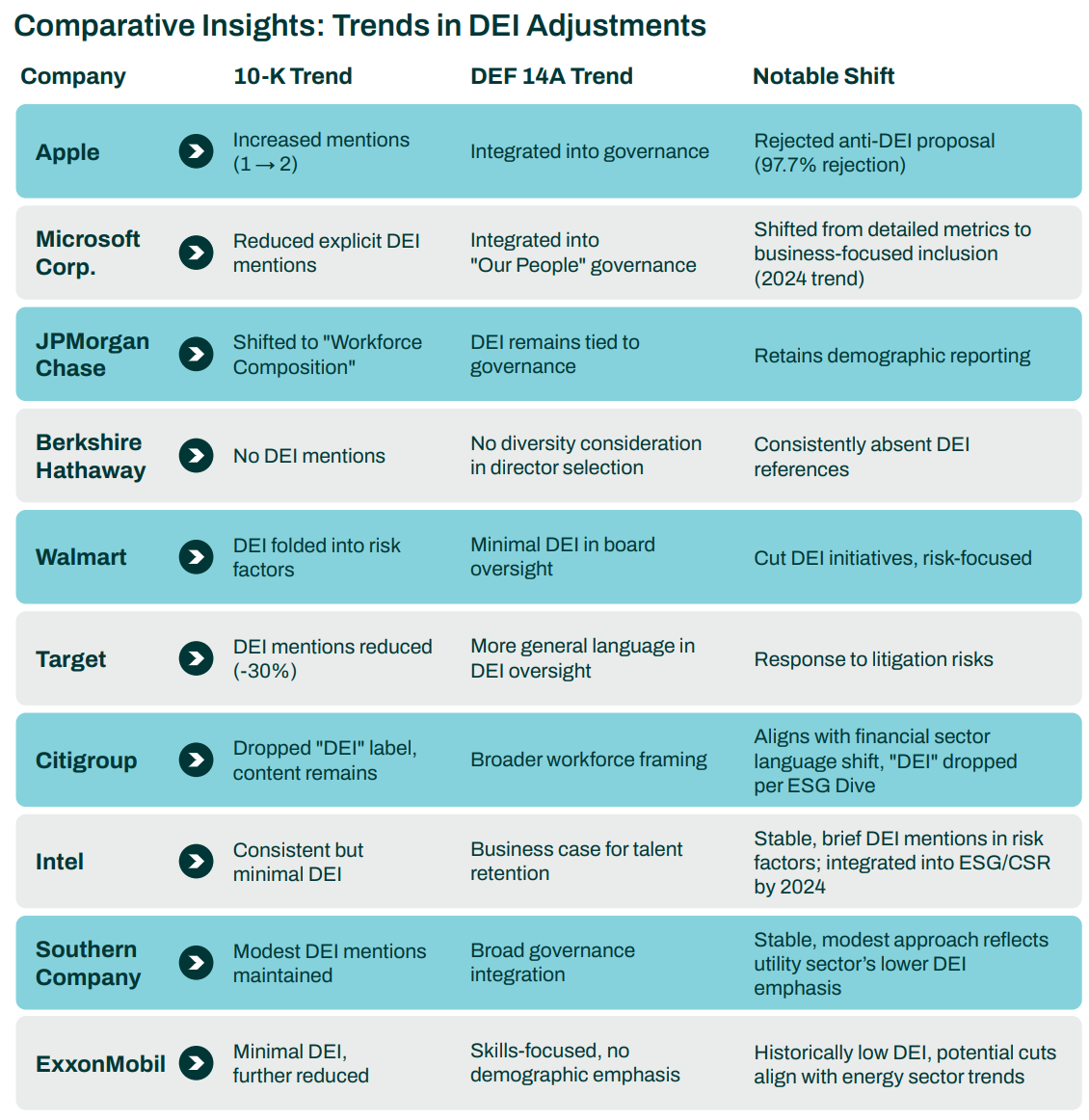

A Strategic Reassessment of DEI Language

The decline in DEI mentions in early 2025 suggests that companies are adjusting to legal and regulatory pressures while still maintaining broad commitments. Apple remains steady, while Microsoft and JPMorgan Chase exemplify the shift toward neutral terminology. Retailers like Walmart experiment with alternative framing, and conglomerates like Berkshire Hathaway continue to avoid DEI disclosures altogether.

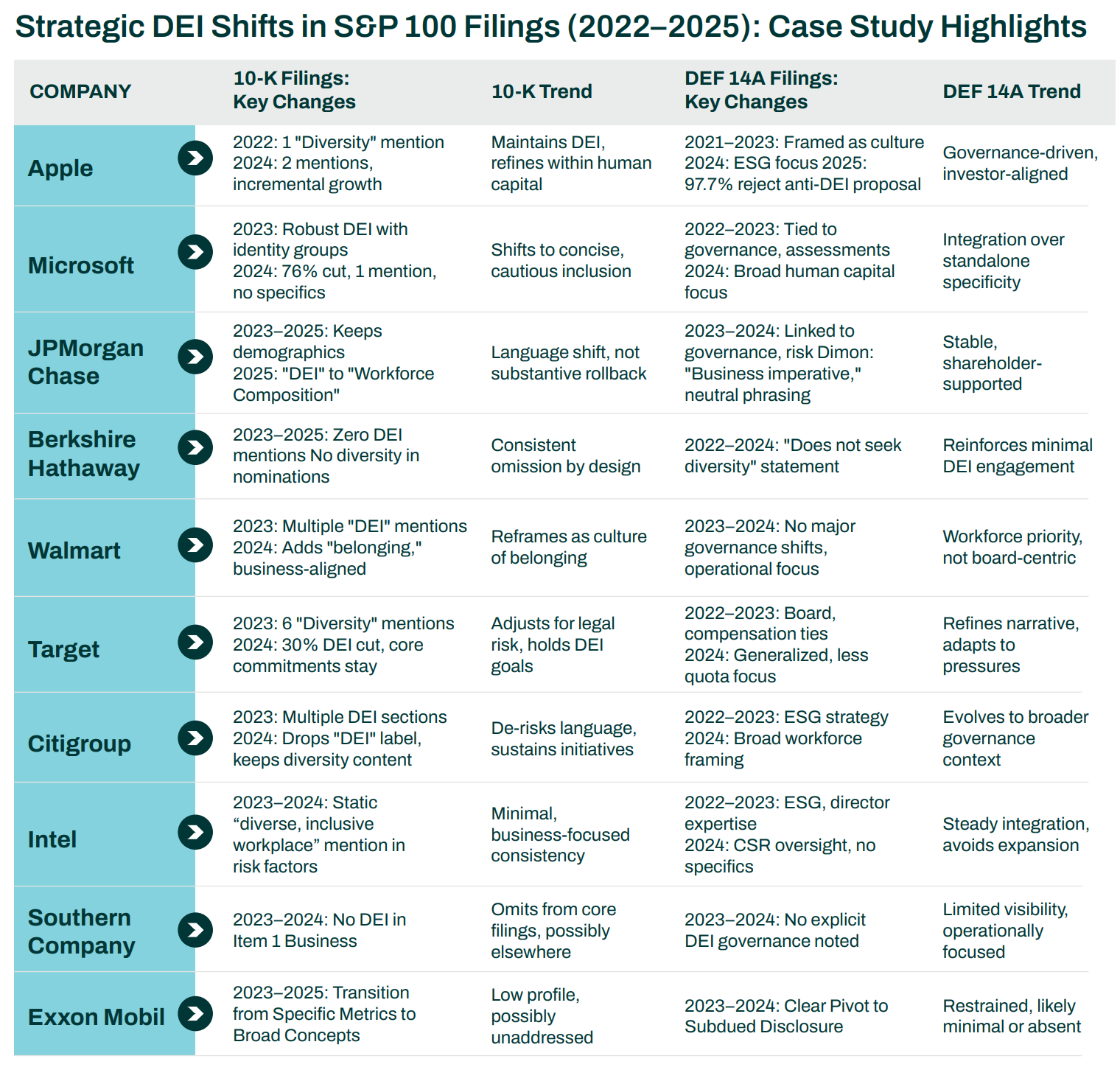

Case Studies: Strategic DEI Shifts in S&P 100 Filings (2022-2025)

This section presents a detailed qualitative analysis of DEI disclosure strategies based on SEC 10-K and DEF 14A filings from 2022 to early 2025. The companies selected for this case study—Apple, Microsoft, JPMorgan Chase, Berkshire Hathaway, Walmart, Target, Citigroup, Intel, Southern Company, and ExxonMobil – represent a spectrum of disclosure approaches, from strategic integration to reduction or omission. Our analysis is strictly filing-based, avoiding any external sources.

Strategic Adaptation in DEI Disclosures

These case studies illustrate a spectrum of DEI disclosure strategies, ranging from Apple’s reinforcement to Berkshire Hathaway’s avoidance. The financial sector, represented by JPMorgan Chase and Citigroup, is shifting DEI language without fully retracting commitments. Target demonstrates resilience amid legal pressures, while Berkshire Hathaway remains a notable exception to corporate DEI trends.

The report concludes that leading S&P100 companies have adapted their Diversity, Equity, and Inclusion (DEI) disclosures in response to a complex regulatory environment spanning 2023 to early 2025, balancing legal pressures with ongoing DEI commitments. This conclusion is rooted in the interplay of four primary regulatory forces, alongside specific company responses and shareholder trends observed across the 10 companies analyzed.

These forces created a “flux” that drove companies to modify their DEI strategies. However, the report emphasizes that modification does not equate to abandonment -companies like Apple and JPMorgan Chase sustained core DEI principles despite pressure.

Shift to Neutral Phrasing:

Legal risks, including litigation tied to race-based policies and state-level anti-DEI laws, prompted a widespread shift to neutral language. Microsoft’s 2024 10-K eliminated identity specifics, reducing its DEI section from ~250 to ~60 words, while Target cut experiential phrasing (e.g., “seen, heard, and welcome”) by 30% in 2024, retaining only general inclusion statements. JPMorgan Chase exemplifies this trend, shifting from “Diversity, Equity, and Inclusion” to “Workforce Composition” in its 2025 10-K while preserving demographic reporting (e.g., 50% women on board by 2025). Walmart adopted “belonging” in 2024, aligning DEI with business outcomes rather than social justice. This neutralizing trend reflects a strategic recalibration to de-risk filings, as companies like Intel and Citigroup also maintained minimal or reframed DEI mentions, avoiding legally contentious specifics.

Persistent Investor Support:

Despite these adjustments, shareholder engagement data indicates robust investor backing for DEI. Apple’s 2025 8-K 5.07 reports a 97.7% rejection of an anti-DEI proposal, signaling sustained support even amid regulatory rollback (e.g., EO 14173). This contrasts with broader caution, as firms like Microsoft and Target scaled back before the EO yet retained commitments like workforce diversity reports and pay equity goals. This analysis suggests investors value DEI as a business imperative—echoed by Jamie Dimon’s statement in JPMorgan’s filings—driving companies to adapt rather than abandon DEI efforts. Berkshire Hathaway’s consistent DEI omission stands as an outlier, while others balance legal prudence with stakeholder expectations.

Conclusion

DragonGC’s analysis underscores a nuanced corporate response: companies are not jettisoning DEI but are recalibrating how it is presented in filings. The intersection of regulatory pressures has led to a measurable decline in explicit DEI mentions yet substantive commitments persist through neutral phrasing (e.g., “inclusive culture,” “workforce composition”) and governance integration (e.g., Apple’s ESG focus). Shareholder support, as seen in Apple’s voting trends, acts as a counterweight, ensuring DEI remains intact despite legal headwinds. This navigation reflects a strategic tightrope—mitigating risks while preserving investor-aligned principles—across these leading companies within the S&P 100.

Link to the full report can be found here.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release